The Benefits of Refinancing

October 11, 2021

Refinancing can seem like an out of reach dream, a headache or too much trouble to deal with. When the reality is that refinancing your home could help put money back into your pockets and prevent budgeting headaches.

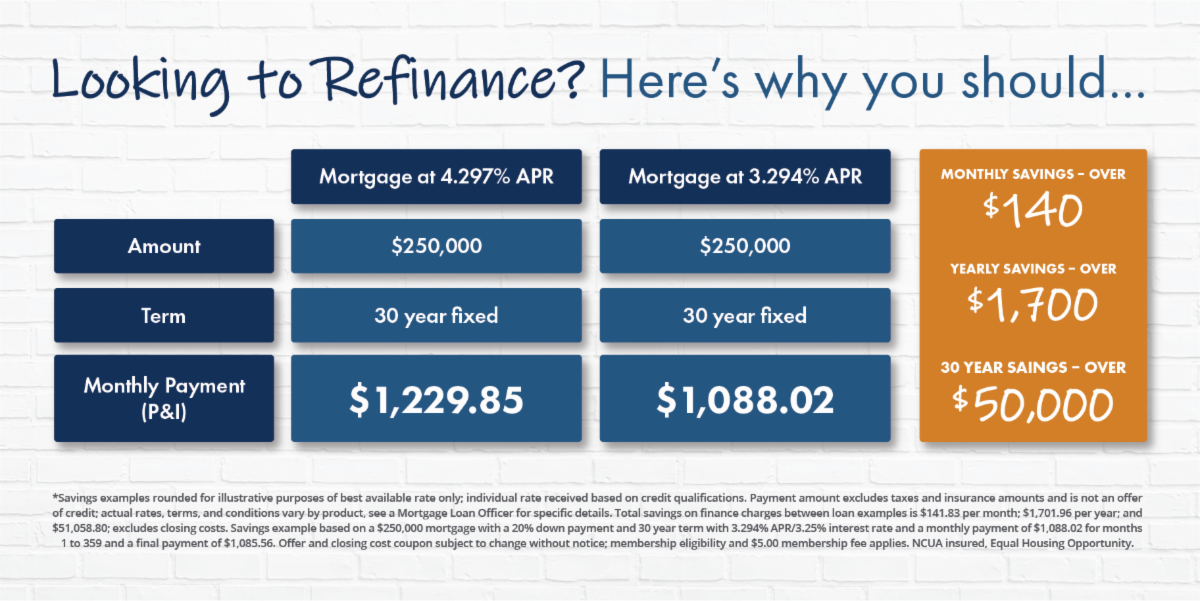

(The graphic above gives a quick rundown of how changing your APR percentage on a 30-year fixed rate with a $250,000 home could potentially save you over $50,000 dollars in 30 years.)

If you are thinking of refinancing your home, consider a few factors; how long you plan on living in your current home, how the current interest rates are looking and how long it will take you to save for closing costs.

One of the main reasons people decide to refinance their home is having the ability to lower their interest rate (APR), which could save them more money each month to put towards other necessities. This could be exciting to some who are looking to potentially make another commitment in their lives, such as having children or purchasing a new vehicle. If you could lower your refinance rate by 1% then it might be valuable to do so.

Another reason someone may want to refinance is to reduce the life of their loan. Sometimes refinancing can decrease the number of months you would need to pay off your home. This could lead to a higher APR percentage, but if you have the funds to shorten it, it could drastically help you pay off your home sooner. This would change your 30-year term to a 15-year term, with changes to APR rate as well.

If you are looking or interested in what Unison can offer you, check out our rates, or speak with a Member Advisor today to begin the process!